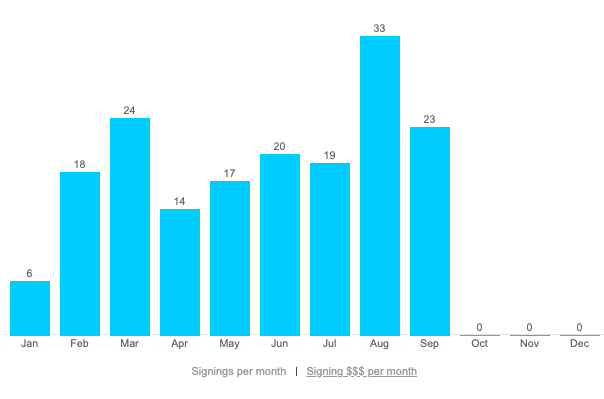

I made the commitment to becoming a loan signing agent on August 2, 2019. Back then I knew that the hardest part of the journey would be to break away from the addiction of driving for Uber and Lyft. The allure of earning fares and cashing out right away is hard to shake regardless of how much it costs in time and money to work as a rideshare driver.

Since the start of the shelter in place orders started in the San Francisco Bay Area I stopped driving passengers and shifted to making food deliveries and increasing the number of loan signings per month. August was the tipping point. I started tracking the percentage of income earned that came from loan signings and set goals to increase it. Here is my review of the loan signing system course which taught me just about everything I know about being a loan signing agent. Just click on the hyperlink or here.

The goal over the remaining months in 2020 is to increase the percentage of income from loan signings from 52 to 90% or higher. I added this new metric to the spreadsheet and, for the sake of accountability, I declared it to my friends in Location Indie on our monthly zoom call.

First Week August 3-9

The first week of August came in HOT! I did not expect to complete 9 signings in 7 days with two days off. The first week of the month gives me a sense on how much business is coming. I prepared myself for a busy August by ordering a fresh case of Hammermill Copy Plus Paper, Blue Ink ballpoint pens, and a couple more reams of legal size paper all from Staples.

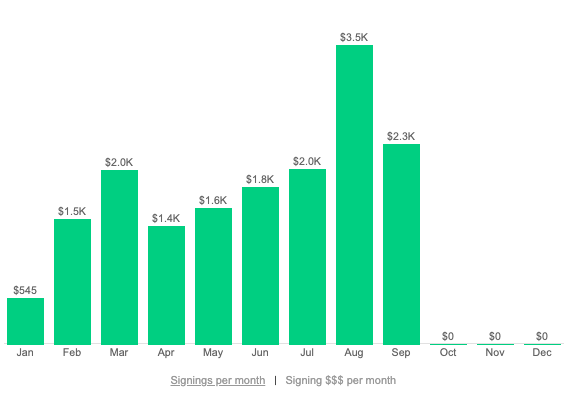

Total earned income for the week from loan signings: $1,000. Percentage of income from loan signings: 82%

Second week: August 10-16

I completed 6 signings and took 2 days off. One of the points that my mentor Mark Wills of the Loan Signing System stresses is to not chase the dollars. He further elaborates to focus on the craft while making each signing your most important signing.

At the start of my loan signing agent career I took that for granted and get myself in a pickle. Not fun and stressful and 1000% my fault because I was trying to hustle and grind through each completing signing and squeezing in rides on Lyft or Uber.

There was no need to overdo it, so I actually set up an away message on Snapdocs (loan signing agent database) and accepted signings from signing services that I had an established relationship with. In this case, Cykix Closing Services and First Classing Signing Service both local to the San Francisco Bay Area.

Total loan signing income for the week: $720. Percentage of income from loan signings: 100%

Third week: August 17-23

The weeks sure do fly when you are having fun and helping families lock in some of the lowest mortgage interest rates in history!

Up until this point, I was on track to hit a new personal record for the number of signings completed in a month (March 2020: 24 signings). By the middle of the week I had four signings and my brain was tired. I needed a break but I didn’t want to have zero income days. I turned on the gig apps for couple of hours on Thursday and Friday to turn off the brain.

I think my mojo was affected by the poor air quality which has kept me from running. Typically, I run between 5-7 days a week which translates into 35-45 miles per week. Additionally, with the end of the month coming up I wanted to be recharged, so I could go above and beyond for the signing services I have been working with. Signings completed: 5 with 3 days off from loan signings.

Total loan signing income for the week: $500. Percentage of income from loan signings: 73%

Fourth week: August 23-30

The final week of the month was amazing! In the loan signing industry they call the last week of the month the “Frenzy” because of two important events happening simultaneously. One, the last day in a month when the loan documents can be signed and fund in the same calender month. Second, the loans that have been started need to close to ease the workload for the following month and so Title Company escrow officers and mortgage loan officers can close their books for the month.

This frenzy was extra busy because of the upcoming Labor Day Holiday and the industry trying to get loan closing completed before the long holiday. Final tally for 11 signings completed with 1 day off.

Total loan signing income for the week: $1,150. Percentage of income from loan signings: 99%

Reflection:

August was a tremondous blessing! I have watched videos from students of Mark Wills’ Loan Signing System share their story on YouTube inspiring me to buy the course and start my own journey. There are so many success stories that sometimes it gets overwhelming but in a good way because you know that the path to success has already been paved. The rest is up to me. This month I took the baton. I shattered the goals I had set up and obliderated every metric I have been tracking.

The pandemic has forced a lot of change, and I am forever grateful that I found the Loan Signing System when I did and took the leap. The result, more time to run the miles I wish to run, and I am paying off loans, credit cards, and other balances on my path to financial independence.

Final stats:

32 loan signing completed

$3,410 from loan signings and general notary work